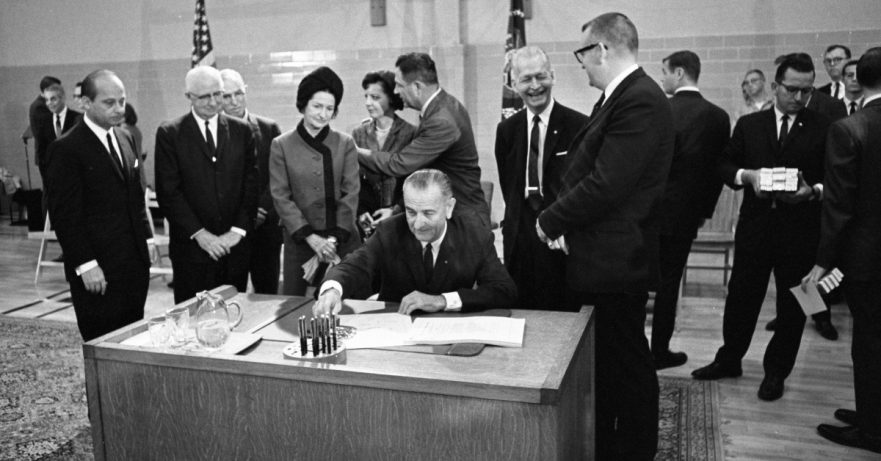

President Lyndon B. Johnson signed the Higher Education Act (HEA) in 1965 at Southwest Texas State College. That legislation was part of President Johnson’s “Great Society” domestic agenda and followed the Civil Rights Act of 1964 and the Voting Rights Acts of 1965. Among many other important elements, HEA established federally backed student loan programs still in operation today. (LBJ Library photo by Frank Wolfe).

Brace yourself for a non-partisan and plainly stated call to action. It matters not what party you support or the political persuasion of the debtors in question. The federal student loan programs are about to cause inestimable harm to millions and that puts democracy in continued peril.

There is very little time remaining in the automatic deferment of federal student loan payments issued by the current administration in response to COVID-19 and rampant economic distress, As of the end of the year, there will be very little in place to keep millions of borrowers from “falling off a cliff.” If you expect racial and economic equity in the education and financial services sectors, please sound the alarm and reach out to those who represent you at the federal level to demand these actions:

- Continued executive order deferring payments; and,

- Immediate implementation of a transition team for the U.S. Department of Education that can determine when borrowers can be provided adequate service and how those loans will be managed responsibly.

I have some good news on this front, and even more that is bad news. It may not surprise you that the good is resident at The Scholarship Foundation of St. Louis. In 2015 the Foundation restored the organization’s interest-free loans and grants to “last dollar”. Due diligence on all funded applications required that each dollar necessary to cover cost of attendance was in place. Scholarship Foundation students who need loans to complete their financial aid now borrow only from the Foundation, interest-free.

We had no way of knowing how smart we were five years ago. That 2015 transition allowed The Scholarship Foundation to provide the kind of debt management support that all low-income students deserve, but few get.

When economic shutdown began affecting our graduates and their families in March, 2020, The Foundation immediately made repayments optional. When the federal government deferred all repayments through the end of September, 2020, so did The Scholarship Foundation. When federal deferment was extended through December, 2020, the Foundation instead began providing increased attention to communications with our borrowers, generating an online request process to allow those unable to resume payments to say so simply. As of the close of October, 2020, the volume of repayments from Scholarship Foundation borrowers exceeds October, 2019, months before COVID began wreaking havoc.

Recent graduates who borrowed interest-free from The Scholarship Foundation are not directly affected by poor management and faulty systems at the federal level. They will not experience a January in which they are expected to pay, have no means to do so, and try to appeal to a federal program that has no transition team working to smooth re-entry of millions into an already beleaguered and outmoded servicing model. When our graduates call, we will answer; more importantly, for months now we’ve been calling ahead and talking with them, one by one.

We have often told the story, in this centennial year, of the first $15.00 interest-free loan made in 1920 by our organization to a young woman pursuing business. We imagine that $15.00 still in circulation, four or five generations later. We are entering the next 100 years strong and resolved. It is distressing that the United States Department of Education is not similarly situated, as millions of students just like ours count on federal loans to make higher education accessible. When borrowers fall off the cliff quickly in the first weeks of the new year, we will all bear the consequences.

To learn more about federal student loans, see:

Federal Student Aid History

Federal Student Loan History

Growth of Federal Student Loans

– Faith Sandler